Table of Contents

A common misconception prevails about Customer Relationship Management (CRM) systems: that only certain businesses need them. In reality, any enterprise with a customer base relying on its products or services can benefit from a CRM in the banking system. Here, CRM helps manage customer interactions across multiple channels, including in-branch, online, and mobile.

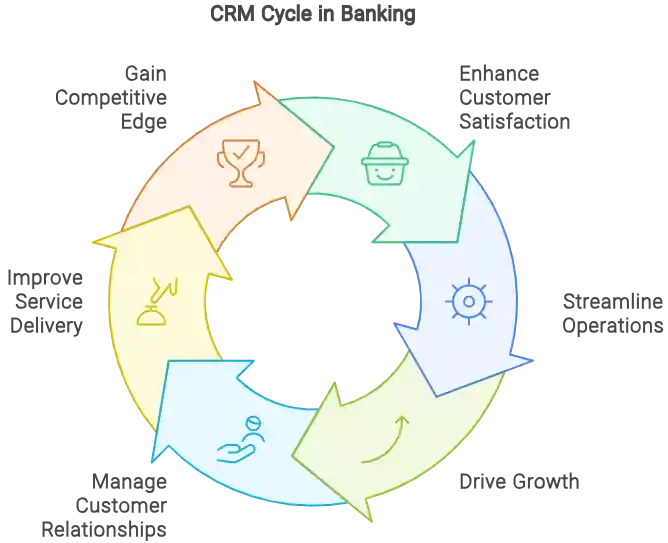

By integrating CRM in banking gain a comprehensive view of their customers, allowing them to offer tailored products and services, enhance customer service, improve satisfaction, and drive growth. This blog delves into the myriad benefits of CRM systems for banks, the unique challenges, strategies to overcome them, and the essential features that make CRM a valuable investment in the banking industry.

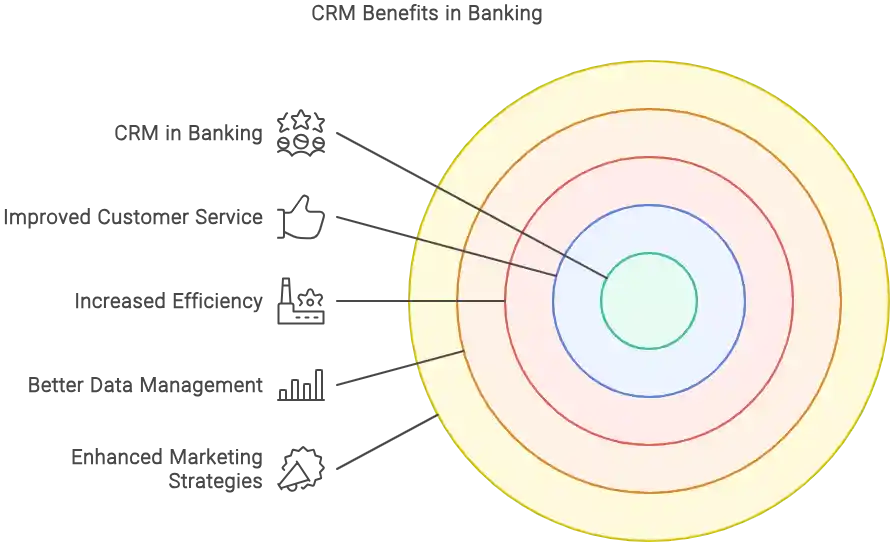

Why Your Bank Needs CRM: Unveiling the Esteemed Advantages

A CRM system in banking acts like a personal banker for every customer on a digital scale. It is a crucial tool that helps banks deliver exceptional customer service, improve user retention rates, and attract new customers. Here are some notable benefits of CRM for banking:

Business Benefits of Using CRM in Banking

Knowing Your Customer Inside Out

CRM systems in banking are not just about storing data; they provide valuable insights. With a 360-degree view of each customer, banks can predict users’ needs, preferences, and financial aspirations. This capability enables banks to provide personalized solutions rather than one-size-fits-all services, enhancing the overall customer experience.

Reinforcing Relationships with Customers

CRM enhances customer relationships by tracking user interactions, preferences, and feedback. This allows banks to personalize their communication and tailor services to individual needs. Whether a first-time customer or a seasoned investor, CRM ensures each customer feels valued throughout their banking journey, fostering trust, loyalty, and a positive experience.

Adhering to Regulatory Compliance

Regulatory compliance, such as GDPR and PCI-DSS, is critical in the banking industry. CRM in banking systems help banks adhere to these regulations by automating compliance processes and securing customer data. This ensures that banks remain compliant without the associated headaches of manual management.

Efficient Data Management

Banks handle vast amounts of data daily and must comply with complex regulations. CRM in banking systems centralize and organize this data, empowering banks to identify trends, make data-driven decisions, streamline operations, and protect sensitive information. This efficiency is vital for maintaining regulatory compliance and operational excellence.

Capturing More Leads

CRM in banking systems in banking act as a powerful tool for gaining and qualifying leads. They enable banks to identify and prioritize prospects based on preferences, behaviors, and financial profiles. By leveraging data insights, banks can tailor marketing campaigns and outreach efforts to resonate with target audiences, maximizing conversion rates and nurturing leads into loyal customers.

Boosting Staff Productivity

CRM in banking software streamlines workflows and automates routine tasks, allowing staff to focus on high-value activities such as client engagement and relationship-building. With centralized access to comprehensive customer profiles and real-time insights, staff can address inquiries promptly, deliver proactive service, and provide tailored recommendations, enhancing efficiency and productivity across departments.

Driving New Business Opportunities

Banks must keep pace with the constantly changing economy and evolving market demands. CRM data and analytics help identify untapped market segments, uncover cross-selling opportunities, and launch targeted campaigns. This proactive approach captures more opportunities and drives revenue growth in the ever-evolving banking landscape.

Revealing the Revolutionary Features of Banking CRM Solutions

While every bank has unique needs, some core features are essential for all CRM in banking solutions. Understanding these features helps make an informed decision before starting your custom banking CRM software development journey.

Essential Features of Banking CRM Software

Enhanced Security Measures

Security is paramount in the banking sector. A robust CRM in banking system offers advanced security features to protect sensitive customer data. Features like encrypted transactions, role-based access controls, and regular data backups ensure that banking assets are safe from cyber threats and comply with regulatory standards.

Easy Integration

CRM in banking systems for banks should integrate seamlessly with third-party applications and existing banking systems, such as loan management and reporting systems. This ensures a smooth transition and maximizes the value of the CRM investment.

Advanced Dashboard and Reporting

An easy-to-use dashboard with robust reporting and data analytics capabilities is crucial for banking staff. These dashboards provide real-time insights and actionable data, helping staff make informed decisions quickly and efficiently. From daily operational metrics to long-term strategic analysis, these reports offer a clear picture of the bank’s performance and areas for improvement.

Predictive Analytics

Predictive analytics takes the guesswork out of banking. By analyzing past customer behavior and transaction patterns, this feature allows banks to anticipate customer needs and offer personalized products and services even before customers request them.

On-the-Go Accessibility

In a mobile-first world, having easy access to CRM in banking on the go is essential. Mobile CRM in banking features allow banking staff to access customer data, respond to inquiries, perform essential tasks on the move, and stay productive anywhere, anytime.

User-Friendly Interface

CRM software for banks should have a visually appealing and intuitive interface that caters to the needs of all users. With a diverse customer base ranging from young adults to the elderly, the CRM system must be user-friendly to accommodate varying levels of digital literacy.

Automated Workflows

Workflow automation is integral to banking CRM solutions. It reduces the need for manual intervention and minimizes the risk of errors. From automating routine tasks like data entry to complex processes like loan approvals, this feature ensures the team can focus on core activities.

Scalability

As banking operations expand, the CRM system must scale to meet growing needs. Scalability ensures that the CRM can handle increasing customer numbers, data volumes, and additional functionalities without compromising performance, supporting the bank’s growth strategies.

360-Degree Customer View

A complete view of each customer is essential for any CRM in banking platform. Banking CRMs should compile up-to-date information on customer interactions, financial history, credit scores, and more. These centralized insights enable staff to quickly retrieve necessary information and provide the best service to customers.

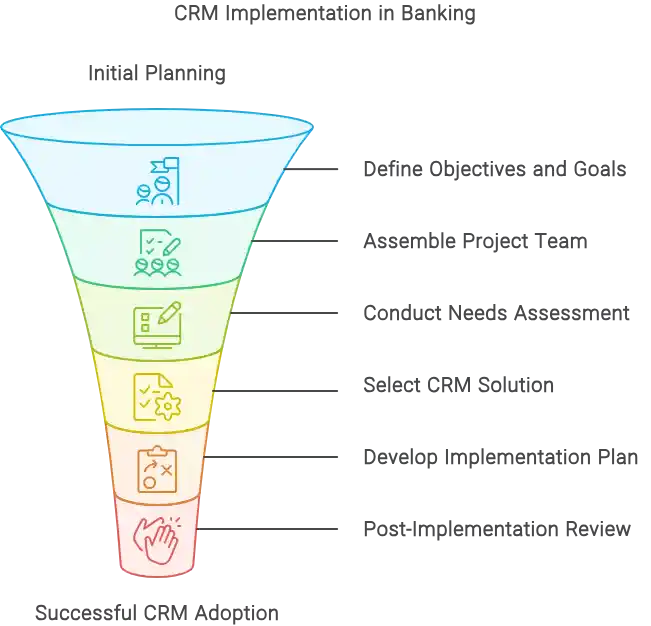

A Step-by-Step Journey to Banking CRM Implementation

Implementing CRM solutions in the banking sector requires a strategic, step-by-step approach to ensure seamless integration with existing systems.

How to Leverage CRM in Banking

Set Implementation Goals

Start by setting clear objectives tailored to your bank’s unique needs and growth goals. Whether it’s enhancing customer relationships, optimizing operational efficiency, or driving revenue growth, defining these objectives is key to successfully implementing CRM.

Seek CRM Consulting

Before advancing in your CRM integration journey, seek the support of skilled CRM in banking consultants. They analyze your requirements, select the right CRM solution, and manage the implementation process, turning your vision into reality.

Custom Banking CRM System Development

After defining goals and gaining expert guidance, proceed with custom CRM software development. Custom CRM in banking ensures the system aligns with the bank’s workflows and goals, offering unparalleled efficiency and innovation. Alternatively, off-the-shelf solutions like Salesforce or Microsoft Dynamics 365 can be considered, with outsourced CRM in banking implementation services ensuring seamless integration.

When integrated with auto finance software, the CRM can also support specialized loan management functions, streamlining workflows and improving customer service in vehicle financing.

Legacy System Data Migration

Transitioning from legacy systems to a new CRM platform involves complex data migration. Through meticulous extraction, transformation, and loading (ETL) processes, outdated data is moved to the new CRM in banking, ensuring continuity and reliability.

Integration with Existing Systems

For seamless operations, CRM systems must integrate with existing banking infrastructure, such as ERP systems and marketing tools. This integration ensures a unified view of customer data across departments, eliminating data silos and improving collaboration.

Continuous Evaluation and Optimization

Post-integration, continuously evaluate and optimize CRM performance. Regularly monitor KPIs and user feedback to refine processes, add features, and ensure the CRM scales with your organization. Continuous optimization keeps your banking business ahead of the curve, driving sustained growth.

After-Launch CRM Support

Post-launch support is essential for long-term CRM in banking success. Technical support, platform maintenance, and regular updates ensure smooth operation, minimizing disruptions and maximizing ROI. Dedicated support addresses evolving challenges, unlocking the full potential of CRM solutions.

Real-World Examples of Popular Banking CRMs

Selecting the right CRM in banking enhances customer relationships and operational efficiency. Here are popular CRMs used in the banking sector:

Salesforce Financial Services Cloud

A leader in the CRM space, Salesforce’s Financial Services Cloud is tailored for banking. It offers a comprehensive view of customers, empowering banks to provide personalized service, enhance engagement, and drive growth.

Microsoft Dynamics 365

Microsoft Dynamics 365 provides advanced CRM capabilities, enabling banks to manage customer data, track interactions, and optimize marketing and sales efforts. It improves customer engagement, automates workflows, and enhances relationship management. Microsoft Dynamics pricing varies based on the plan and features selected, allowing businesses to choose the best option for their needs.

Odoo

Odoo is an open-source CRM platform offering flexibility and customization. With various modules covering different aspects of banking operations, Odoo allows banks to tailor the system to their specific needs, ensuring maximum benefit.

Overcoming Roadblocks in CRM Implementation

While CRM offers numerous benefits, implementing it in banking comes with challenges. Here are common issues and strategies to overcome them:

Data Security

Challenge: Protecting sensitive client information and account records from cyber threats is crucial yet challenging.

Solution: Develop CRM systems with robust security measures such as encryption, access controls, and data backups to ensure high information security and maintain credibility.

Integration Complexity

Challenge: Legacy IT infrastructure can make CRM integration daunting, risking data loss and system failure.

Solution: Streamline integration by outsourcing to a reliable CRM implementation company familiar with handling complex legacy systems. This ensures smooth interoperability and minimizes operational disruptions.

Resistance to Change

Challenge: Employees may be hesitant to switch to a new system, disrupting familiar routines.

Solution: Prioritize change management strategies, promote adaptability, and provide comprehensive training to empower employees to embrace the new system positively.

Conclusion

CRM systems play a transformative role in banking by enhancing customer relationships, streamlining operations, and driving growth. From personalized service and improved data management to compliance and productivity boosts, CRM offers numerous benefits. Implementing a CRM system requires careful planning, clear objectives, and a focus on data